25. Almost everyone is now exempt from the estate tax.

Before tax reform, few estates were subject to the estate tax, which applies to the transfer of property after someone dies. Now, even fewer people have to deal with it. The amount of money exempt from the tax — previously set at $5.49 million for individuals, and at $10.98 million for married couples — has been doubled.

26. Adjustments for inflation will be slower.

The new legislation uses “chained CPI” to measure inflation. It’s a slower measure than what was used before. Over time, that will raise more money for the federal government, but deductions, credits and exemptions will be worth less.

27. Oh, and the individual mandate on health insurance has been scrapped.

Republicans failed to repeal Obamacare earlier this year, but they managed to get rid of one of the health law’s key provisions with tax reform. The elimination of the individual mandate, which penalizes people who do not have health care, goes into effect in 2019. The Congressional Budget Office has predicted that as a result, 13 million fewer people will have insurance coverage by 2027, and premiums will go up by about 10% most years.

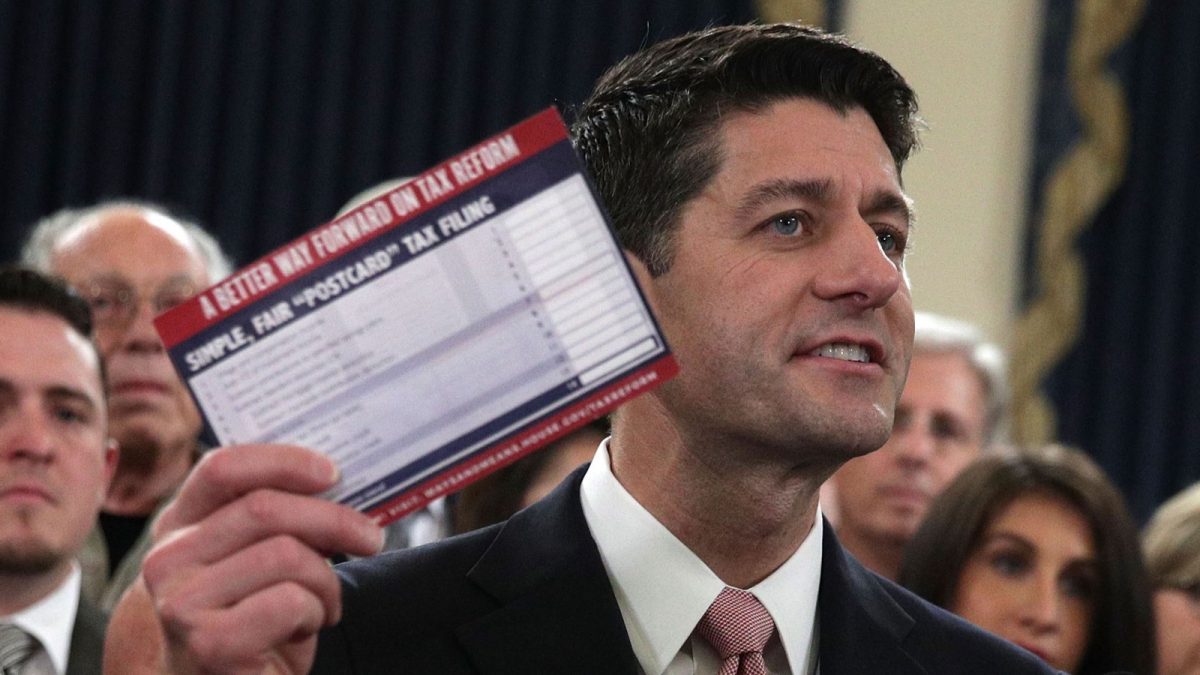

28. You won’t be able to file your tax return on a postcard.

Trump said H&R Block would go out of business after tax reform because filing taxes would become so simple. Not quite. While doubling the standard deduction will ease the process for some individuals, there’s still a web of deductions and credits to work through. And for small businesses, filing could become even more complicated.

29. The corporate tax rate is coming down.

The corporate tax rate has been cut from 35% to 21% starting next year. The alternative minimum tax for corporations has been thrown out altogether. Earnings are expected to go up as a result.