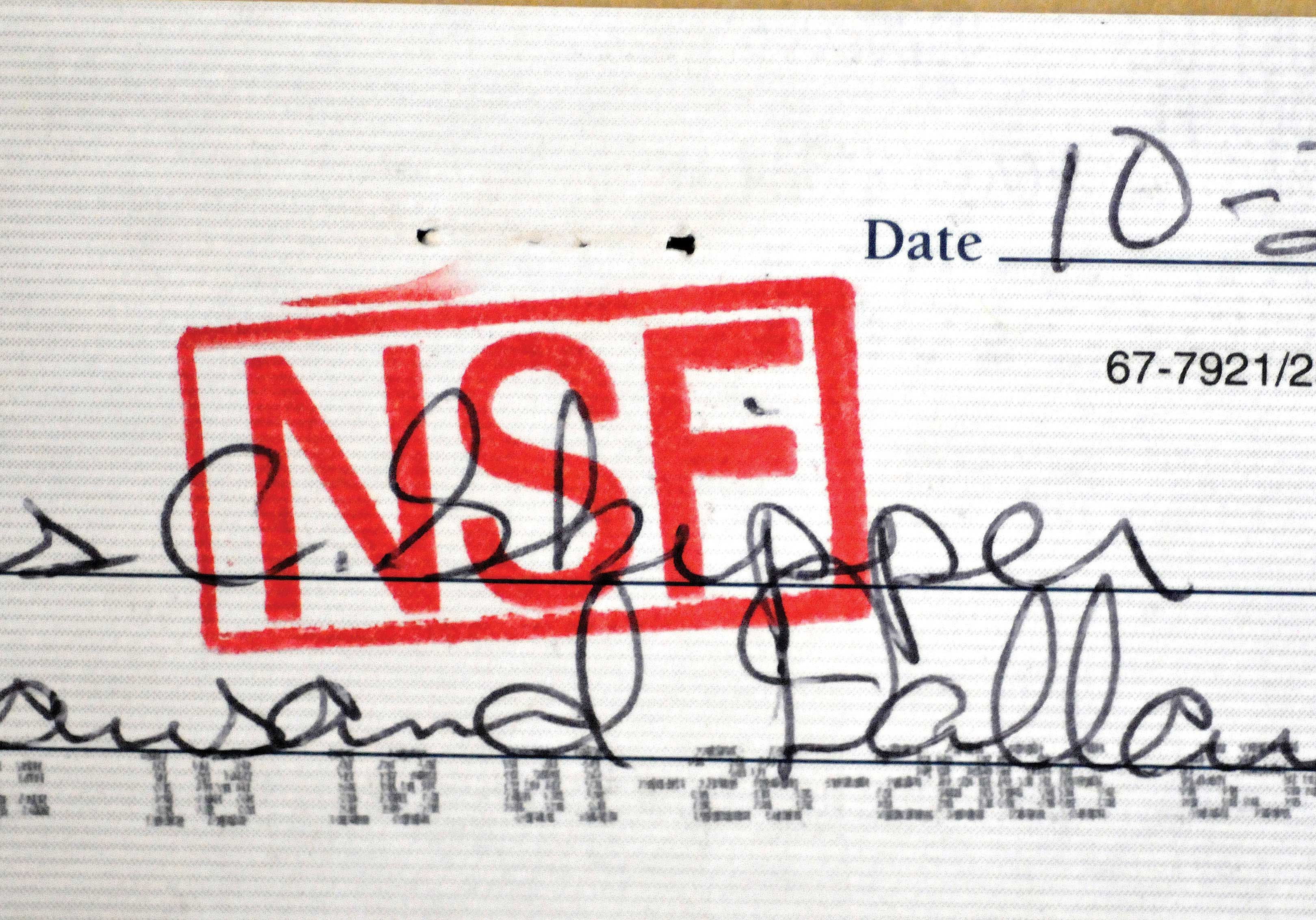

1. Non-Sufficient Funds Fee

Financial institutions impose a non-sufficient funds fee when you try to write a check for more than you have in your account, but the bank declines the transaction. Banks typically charge the same amount for a non-sufficient funds fee as they do an overdraft fee, according to the Consumer Finance Protection Bureau, but usually won’t charge you a debit card transaction fee when a debit card transaction is declined.